As a church accountant with years of experience under my belt, I've seen the inside workings of many small to medium-sized churches. I've witnessed firsthand the transition from traditional ledgers to modern software, and let me tell you, it's been quite a journey. This article is for you, pastors of small to medium churches, to help navigate the maze of myths and realities surrounding church accounting software.

Myth 1: Church Accounting Software is Too Complex for Small Churches

Reality: User-Friendly Design for Non-Accountants

One of the most common myths about church accounting software is that it's too complex for small churches. I remember working with a pastor from a small congregation who was terrified of technology. The thought of using software for accounting was daunting. But here's the thing: modern church accounting software is designed with you in mind. It's intuitive, user-friendly, and believe it or not, quite forgiving. This pastor, with a bit of guidance and practice, became a pro at using the software. It’s more about willingness to learn than about the complexity of the software.

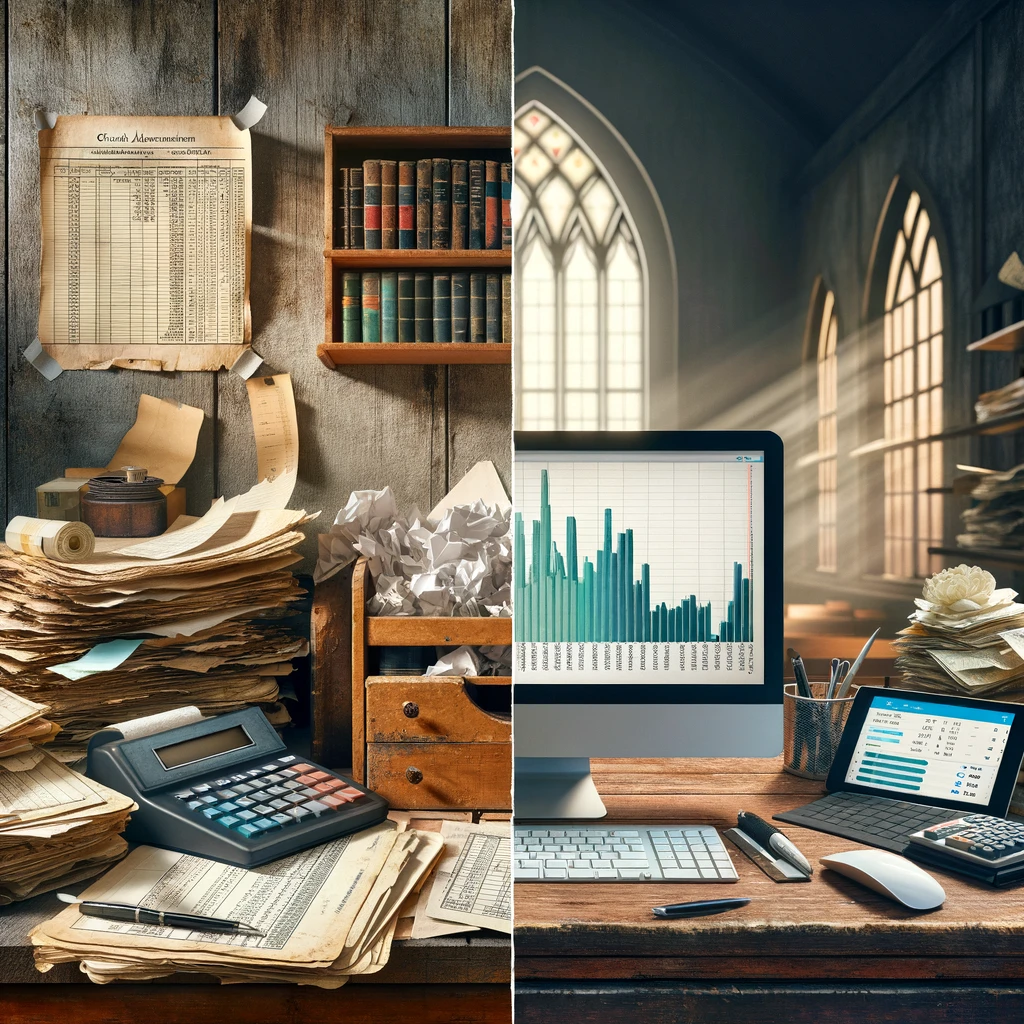

Myth 2: Manual Accounting is Cheaper and Just as Effective

Reality: Cost Savings and Efficiency Gains

Another myth we often hear about church accounting software is that manual accounting is cheaper and just as effective. Sure, pen and paper don't cost much, but think about the hours spent laboring over books, the potential for human error, and the difficulty in generating reports. I've seen a church switch from manual to software-based accounting, and the difference was night and day. The time saved on routine tasks alone justified the investment. Plus, many software solutions are quite affordable, offering tiered pricing to fit different budgets.

Case Study: The Efficiency Leap

A church I worked with once used manual methods for everything. After switching to software, they cut down their financial management time by half. This freed up precious hours for pastoral care and community outreach – the real heart of church work.

Myth 3: Church-Specific Accounting Software Doesn't Offer Any Additional Benefits

Reality: Tailored Features for Church Needs

One prevalent myth is that church-specific accounting software doesn't offer any additional benefits compared to general accounting software. This is far from the truth. Church-specific software comes with features like fund accounting, donation tracking, and tax compliance tools – all tailored to the unique needs of churches. This isn’t just a fancy add-on; it’s about having the right tool for the job.

Compare and Contrast: Specialized vs. General Software

Imagine tracking designated donations for a building fund or a mission trip using general software. It’s doable, but cumbersome. Church-specific software, on the other hand, makes this a breeze, ensuring that funds are correctly allocated and reported.

Myth 4: Implementing New Software Will Disrupt Church Operations

Reality: Seamless Transition and Training

A common fear is that implementing new software will disrupt church operations. This is another myth about church accounting software. Adopting new software doesn’t mean putting church life on hold. Most providers understand the importance of a smooth transition. They offer training, support, and resources to get you up and running without disrupting your church’s daily operations.

Tips for a Smooth Transition

When a church I worked with decided to switch to a new accounting system, we planned the transition to occur during a quieter period in the church calendar. We also made sure staff had access to training resources. The changeover was smoother than anyone had anticipated.

Myth 5: Data Security is a Major Concern with Cloud-Based Solutions

Reality: Advanced Security Measures

As church leaders, let's talk about something that often gives us sleepless nights – the safety of our church's financial data. Many of you might think that storing this sensitive info in the cloud is like leaving the church doors unlocked all night. But here's the deal: reputable cloud-based accounting software providers have security measures that are nothing short of Fort Knox.

First off, let's break down what we mean by 'encryption'. Imagine your financial data is a secret message. Encryption turns this message into a code that only someone with the right key (in this case, authorized users like you) can read. It's like having a secret language for your data.

Regular backups are another superhero in this story. They're like having an emergency backup choir ready to step in if the main choir loses their voices. If anything goes wrong, like a data loss or a system failure, these backups ensure your financial data isn't lost. It’s like having a digital safety net.

Strict access controls are the bouncers at the door, checking IDs. They make sure only the right people can access your church's financial data. You can even set different levels of access – for example, allowing the treasurer full access while volunteers can only view certain sections.

Data Security in Practice

Let me tell you about a church I worked with as a client. They were old school, keeping everything on paper and a little hesitant about moving to the cloud. Their main worry? Security. It's a big leap of faith, right? But once they understood the nitty-gritty of how their data would be protected, their mindset shifted.

We walked through the encryption process – how their data would be turned into that secret code I mentioned. We talked about how, even if a hacker got their hands on the data, it would be like reading gibberish without the decryption key.

Then, we discussed backups. Their eyes lit up when they realized they wouldn’t have to panic about losing everything in a computer crash or if physical records were damaged.

But the real turning point was understanding the ease of secure access. Being able to check their financials from home or during outreach activities, all while knowing it was safe, was a game changer.

The bottom line here is that cloud-based solutions offer a level of security that's hard to match with traditional methods. It's about protecting our church's financial health with the same care and attention we give to our congregation's spiritual health. So, when considering a move to the cloud, remember – it's not just about keeping up with technology; it's about safeguarding our church's future.

The Bigger Picture: Embracing Technology in Church Management

How about we talk about something crucial yet often overlooked – incorporating technology into our church operations. Now, I know what you're thinking: "Technology sounds complicated, and we've been managing fine so far." But hear me out. This isn't just about jumping on the digital bandwagon. It's about smartly stewarding the resources we've been blessed with.

When we talk about efficient accounting practices, we're not just discussing numbers and spreadsheets. It's about freeing up our most valuable assets – time and energy. This shift allows us to focus more on what's at the heart of our mission: our ministry and serving our community.

Think of technology as a tool, not a burden. With the right church accounting software, you can automate those time-consuming tasks like tracking donations, managing funds, and preparing financial reports. This means less time hunched over ledgers and more time for pastoral care, community outreach, and yes, even some much-needed family time for you and your team.

Personal Anecdote: The Transformation

I'll never forget the transformation I witnessed in a pastor who was initially quite hesitant about using church accounting software. He was a bit old-school and loved his paper records. The turning point came when he saw firsthand how much more he could achieve with the time saved.

We introduced a simple, user-friendly accounting software tailored for our church's needs. At first, he was skeptical, but as he learned to use it, something amazing happened. He found he was spending less time bogged down by financial administration and more time doing what he loved – engaging with the congregation and planning community events.

It was like a light bulb went off. He realized that this technology wasn't replacing his role but enhancing it. He could now access financial reports with a few clicks, track donations effortlessly, and even view financial trends that helped in decision-making. And the best part? He had more time to spend on pastoral visits, community service, and expanding our church's outreach programs.

His transformation from a hesitant observer to a passionate advocate for church accounting software was a sight to behold. He even started encouraging other pastors to make the leap, sharing his story and the noticeable differences in our church's engagement and growth.

So, my fellow leaders, let's not shy away from technology. Embracing it can lead to incredible growth, not just in efficiency but in our capacity to serve and connect with our community. Remember, it's not about replacing the human touch in our ministries; it's about enhancing it, making our efforts more impactful and far-reaching. Let’s take this step together, for our churches and the communities we cherish.

Conclusion

Ditching the old ledger for accounting software might seem daunting, but the benefits far outweigh the initial discomfort. As pastors and church leaders, embracing these tools can lead to more efficient management of church finances, allowing you to focus more on your congregation and community.